40+ Refinance mortgage how much can i borrow

For borrowers trying to decide whether they. In this example the lender would be willing to offer a loan amount of 171000.

Canada Mortgage Refinance Calculator 2022 Wowa Ca

In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds.

. Should I consolidate my loans. What is my loan rate. Refinance to a shorter loan.

That would give him 1750 a month to put toward a housing payment. How much will my loan payments be. How much can I borrow.

Refinancing a mortgage can be costly however these costs can be recouped over time if youre refinancing to a loan with a lower interest rate. Refinance Your Mortgage Home Equity Loans PURCHASE 30-YR FIXED-RATE MORTGAGES. A standard valuation fee alone can be between 200-500.

How to borrow from home equity. Lenders assess different financial factors to gauge your creditworthiness. You can refinance with the equity you have in your existing home.

The mortgage pre-qualifying process is an informal assessment of your ability to repay a loan. In 2017 there were about 600 billion in mortgage refinance loans 109 trillion in purchase mortgages so purchases were nearly 23 of the market while refis were slightly more than 13 of the market. Most mortgage loans require a.

According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them. How much can I afford to borrow. When you buy a house and finance with FAIRWINDS you can get the best mortgage rates and terms like a 15-year mortgage with a 5123 APR or a 30-year mortgage with a 5870 APR.

You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. 10-year fixed-rate loans have lower rates compared to 30-year and 15-year fixed-rate mortgages. The discharge fee will generally cost between 100-400.

They typically request at least 5 deposit based on the value of the property. Reverse Mortgage Line of Credit. If a house is valued at 180000 a lender would expect a 9000 deposit.

No quick relief in rent increases economist explains. Blended Rate Calculator Calculates a first and second mortgage blended rate. Thats about two-thirds of what you borrowed in interest.

You can refinance your mortgage to take. Visit our accessibility help page. When to consider a refinance of your reverse mortgage.

How Much Can You Afford to Borrow. Lenders generally prefer borrowers that offer a significant deposit. Your home value has increased considerably.

It takes less than 3 minutes to calculate your borrowing power. The rate on the 30-year fixed mortgage slipped to 499 from 53 the week prior according to Freddie Mac. Predictable rate for the life of the loan.

Assuming a 30-year mortgage that amount of 630000 can then be used to gradually pay for his mortgage over the next 360 months. If you can afford to make higher monthly mortgage payments consider refinancing to a shorter-term loan. Inflation has been the highest in 40 years and.

Before you can obtain a mortgage you must undergo a qualification process. The setup fees for the new loan can cost between 300-1000. Liabilities and mortgage terms affect the loan amount you can borrow.

The credit line option. Borrowers may also refinance into a shorter term to reduce their current rate. However if the value has changed significantly you may need to provide deposit up to 10 of the propertys value.

The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. You can shorten your loan term You can refinance your 30-year mortgage to a 15 year loan to pay it off faster and for less interest overall. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage.

So the value of the property can also limit how much you can borrow. Computes minimum interest-only and fully amortizing 30- 15- and 40-year payments. To better understand what rates you may qualify for including what the average mortgage or refinance rate is in your area take a look at Credit Karmas marketplaces for mortgage rates and mortgage refinance rates as well as our latest state-specific guides.

FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment. Mortgage or refinance rates depend on different factors including where you live. If you can afford to make higher mortgage payments you should consider taking a short term.

This provides you a ballpark estimate of how much you can borrow from a lender. Your total interest on a 250000 mortgage. Advanced Option ARM Calculator with Minimum Payment Change Cap.

If you are using a screen reader or other auxiliary aid and are having problems using this website please contact us at 18006337077. Riverside Centre 40123 Eagle St Brisbane City QLD 4000. For example if you currently have a 30-year mortgage.

Since mortgage rates are changing daily this means the mortgage rate today may be different than the one you see when you are approved for a home loan. As rates are expected to keep rising refinance is expected to make up a smaller share of the overall market. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

How To Use A Mortgage Calculator Comparewise

Professional Loan Repayment Notice Template Doc In 2022 Money Template Free Family Loan

1

What Is A Collateral Mortgage Benefits Vs Risks Wowa Ca

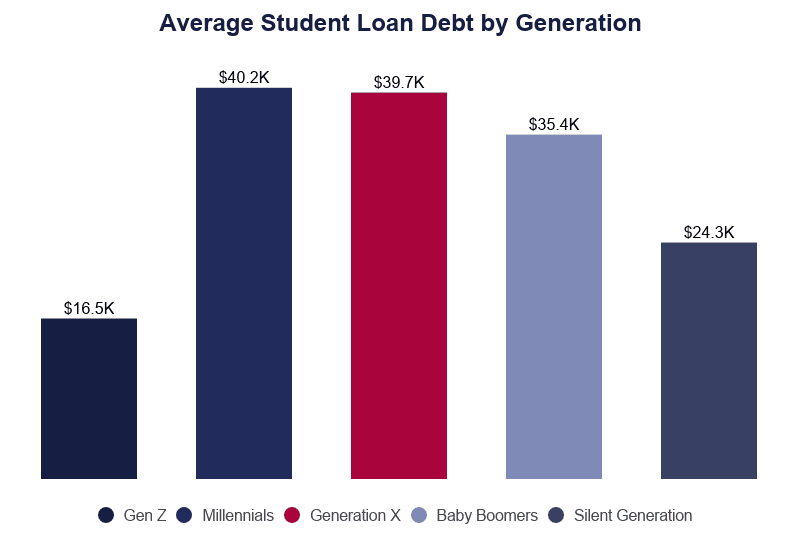

Average Student Loan Debt By Age 2022 Facts Statistics

Na Zgomvhygwqm

Heloc Calculator Calculate Available Home Equity Wowa Ca

If I Schedule My Mortgage Payment For The 15th Instead Of The First Of Every Month Will I Pay Significantly More Interest Over The Life Of The Loan Quora

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

1

1

Magical Credit Review September 2022 Pros Cons Features Pricing Comparewise

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab With Regard To Blank Loan Agreement Template In 2022 Private Loans Loan Agreement

Mortgage Refinance Guide Procedure Costs Calculator Wowa Ca

How To Get A Mortgage With Bad Credit Comparewise

Other Than The Banks And Loan Firms When People Borrow Money From Their Friends Coworkers And Relatives They Letter Sample Business Letter Sample Lettering

1