Tax deferred annuity calculator

Should your financial needs change you can. Income Tax Calculator - How to Calculate Income Taxes Online for FY 2020-21 AY 2021-22 with ICICI Prulifes Income Tax Calculator.

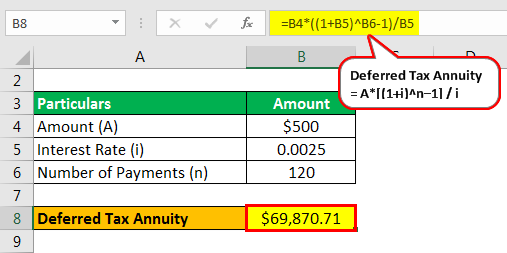

Tax Deferred Annuity Definition Formula Examples With Calculations

Single premium plan to get guaranteed income for life with the option to defer income by upto 10 years.

. 2022 Immediate Annuity Rates Immediate Annuity Income Quote Calculator Whats an Immediate Annuity SPIA DIA QLAC. Fixed deferred annuities also provide you with a guaranteed minimum interest rate regardless of market conditions. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they are withdrawn from the account.

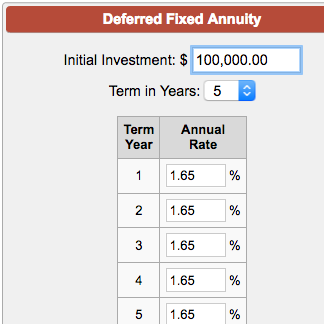

With a fixed deferred annuity a guaranteed interest rate is locked in for an initial period. It is always a good idea to consult your tax legal and financial advisors regarding your specific situation. Present Value Of Annuity Calculator Terms Definitions.

Annuity A fixed sum of money paid to someone typically each year and usually for the rest of their life. The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home. And amount to invest in our Annuity Quote Calculator and click the Get My Quote button.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. This is a stream of payments that occur in the. Applicable Tax Rate for Super Senior Citizen 80 years or above Up to 3 Lakh.

Calculate the year end values compounded effective interest rate taxes and post-tax value for an annuity. Annuity Calculator shows quotes for lifetime annuities both immediate and deferred annuities. Compare 143 fixed annuities 2 to 10 years in length to achieve the highest fixed annuity rates in the United States.

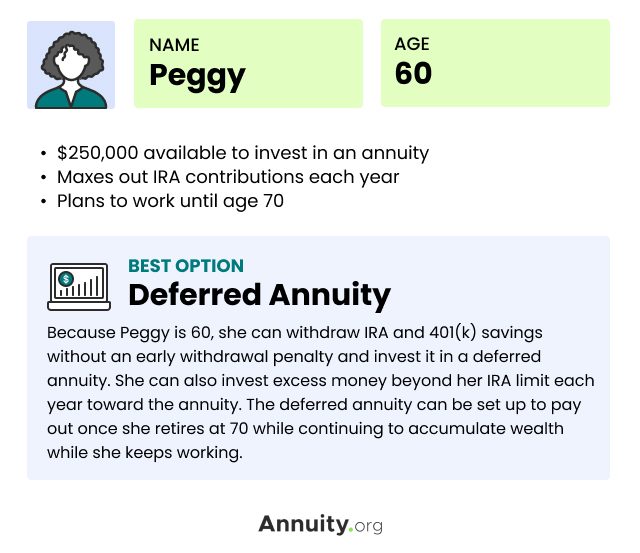

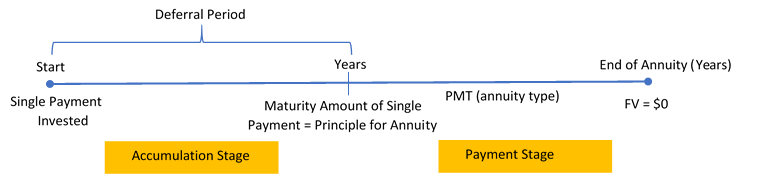

Using the deferred annuity calculator the f future value of annuity formula of the usual rental a series at the end of each month is calculated. That initial investment will grow tax-deferred throughout the accumulation phase typically anywhere from ten to 30 years based on the terms of your contract. Assets in a tax-qualified retirement plan already enjoy tax deferral.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. ICICI Pru Guaranteed Pension Plan New Deferred Annuity. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

In exchange for one-time or recurring deposits held for at least a year an annuity company provides incremental. This permits earnings on premiums to avoid income taxation until distribution. If taxes are a concern a fixed deferred annuity may be a better option.

The following are additional tools to help with your annuity research. Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account. S.

Annuities can be classified by the frequency of payment dates. Several formulas are also used such as the standard renewal formula. Deferred Annuity Calculator See note 1.

A 1035 Exchange taken from the Internal Revenue Code section of the same number is an IRS provision in the tax code that allows policyholders to transfer funds from a life insurance plan endowment or annuity to. To calculate the future value the following typical pension formula is used. A Fixed Annuity can provide a very secure tax-deferred investment.

Use Income Tax Calculator India for free. Compare the 3- 5- and 10-year Fixed Guaranteed Growth Annuities. When you are shopping for immediate annuity rates or immediate annuity quotes it is good to understand that this is the most fundamental pure form of an annuitySingle Premium Immediate Annuities acronym SPIA date back a couple of.

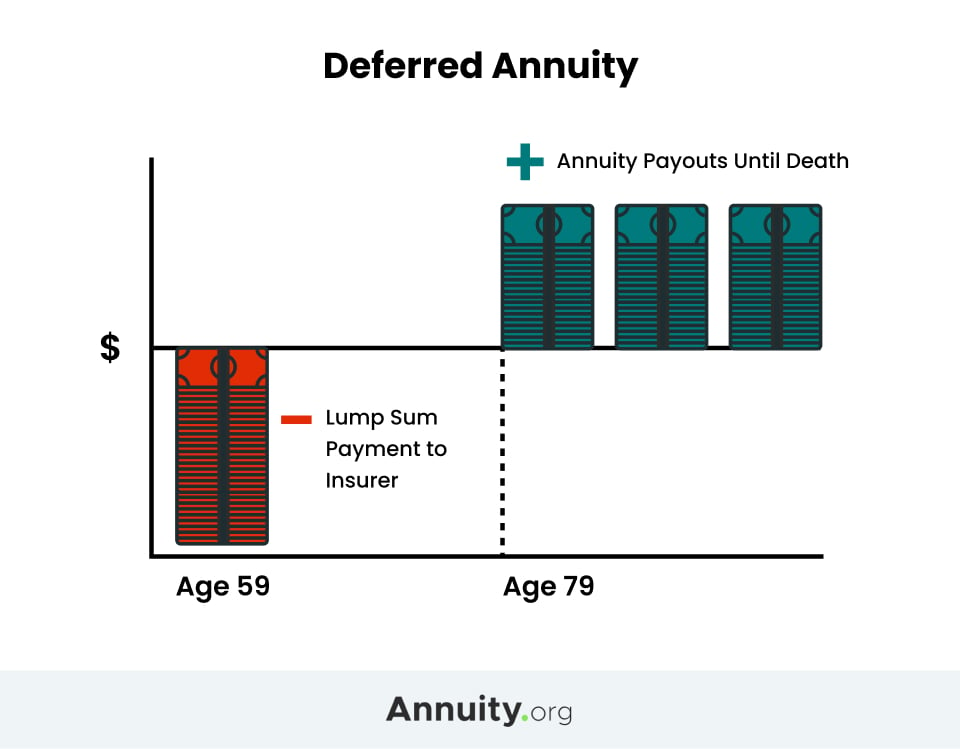

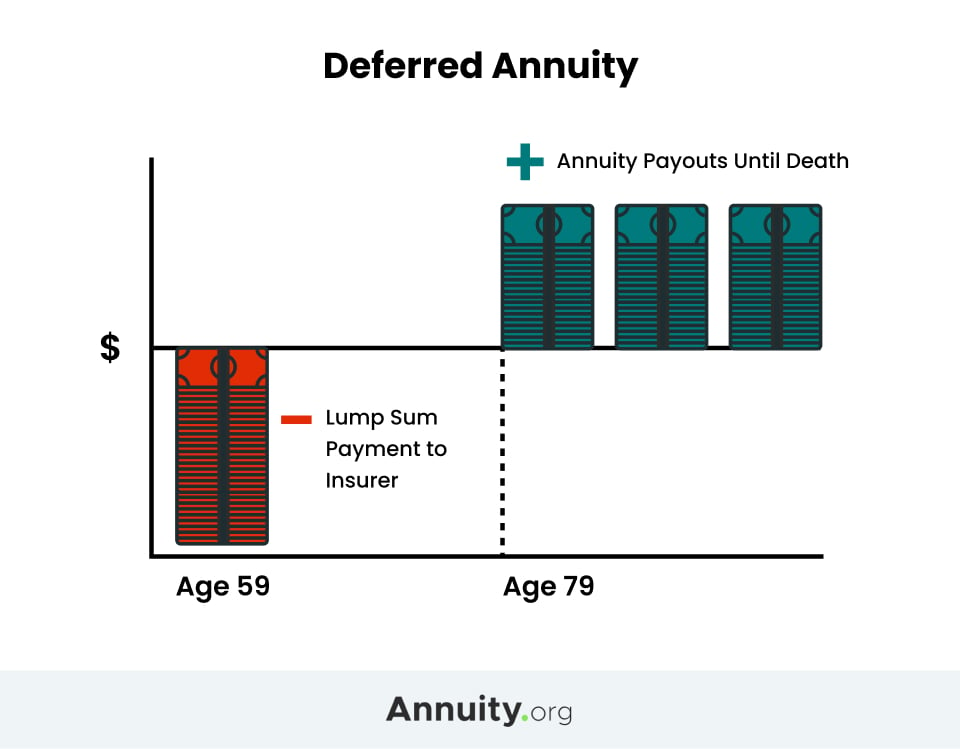

Many people roll over tax qualified funds into a tax-deferred immediate annuity. Annuity calculator - Calculate the annuity value of different types of annuities such as immediate annuity deferred annuity fixed annuity etc. A deferred annuity is an annuity that begins at some point in the future.

This calculator can calculate the payment amount for a deferred annuity given the present value number of payments and interest rate. Use this calculator to help you determine how a Fixed Annuity might fit into your retirement plan. Compare 143 fixed annuity rates.

The payments deposits may be made weekly monthly quarterly yearly or at any other regular. Furthermore this tool does not ensure the availability of or your eligibility for any specific product. Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments.

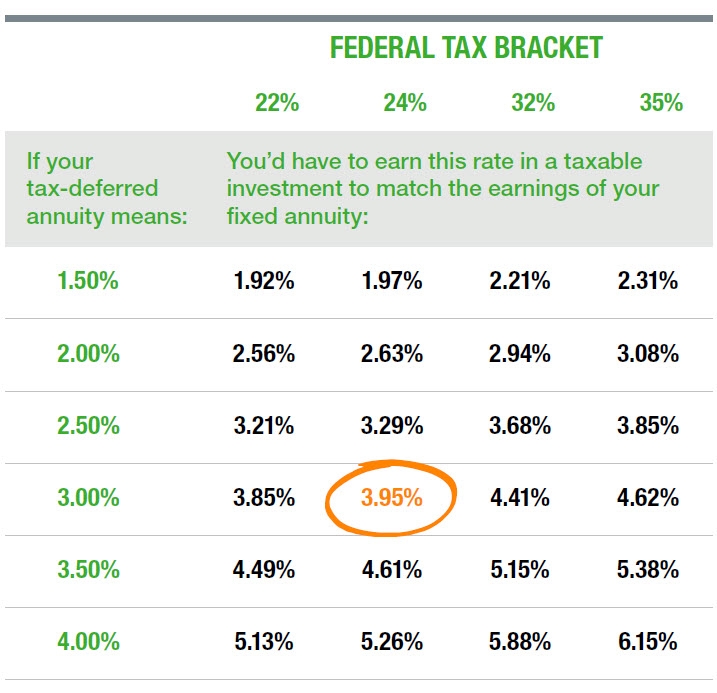

Earnings in annuities grow and compound tax-deferred which means that the payment of taxes is reserved for a future time. Payout schedules determine the duration of. Your quote will appear instantly on the next page.

A deferred annuity is an insurance contract that generates income for retirement. Immediate annuities can payout within a year of purchase. 01 Flexibility for the future.

Interest is compounded monthly by default but you can select your compounding period. Annuity payment options depend on the type of annuity purchased. After that interest rates may be adjusted each year.

Just plug in the amount of the loan your current home value the interest rate the length of the loan any points or closing costs and your annual taxes insurance and PMI. Tax deferred growth is arguably the most appealing feature of a non-qualified annuity. Output shows three options including Full Cash Refund.

The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. Therefore a tax deferred annuity or fixed deferred annuity. By following annuity rules earnings will accumulate on a tax-deferred basis until withdrawals are ready to be made.

PaymentWithdrawal Amount This is the total of all payments received annuity or made loan receives on the annuity. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Deferred annuities take years to payout as the tax-free annuity grows with interest.

Often the user only pays taxes when they receive the monthly payment so you pay taxes over time. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. A fixed annuity is a tax-deferred high yield savings account for retirement competing with the best CD rates today.

An annuity is a series of payments made at equal intervals. Initial Investment Amount or present value that you are putting into your annuity Term Year Annual Rate. Once the annuitization or distribution phase begins again based on the terms of your.

In essence when you buy a deferred annuity you pay a premium to the insurance company.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

What Is A Deferred Annuity Pros Cons Of Deferred Annuities

What Is A Deferred Annuity Pros Cons Of Deferred Annuities

Deferred Annuity Calculator

Deferred Fixed Annuity Calculator

Deferred Annuity Calculator

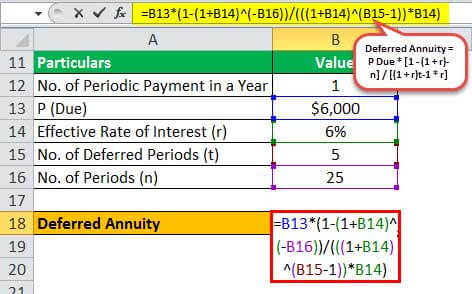

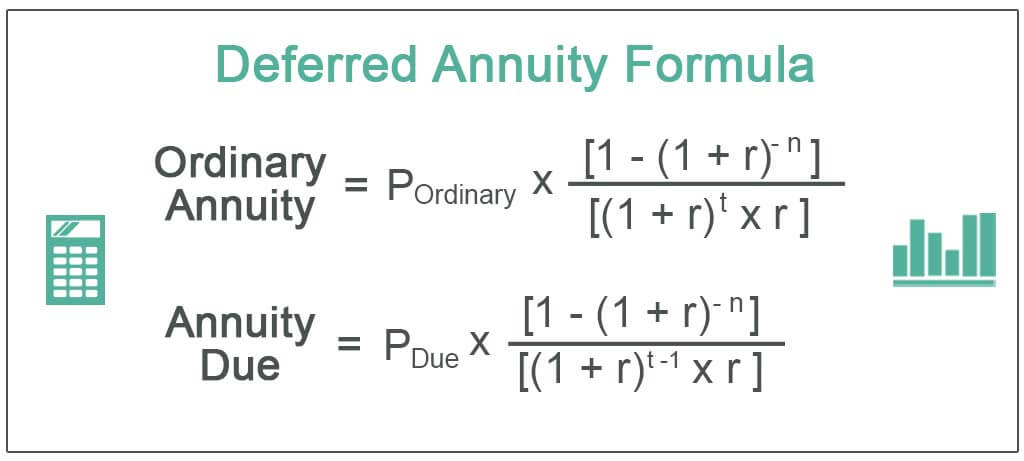

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

How I Really Feel About Variable Annuities Annuity Variable Annuities Stock Market

Annuity Taxation How Various Annuities Are Taxed

Tax Deferred Annuity Definition Formula Examples With Calculations

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Deferred Annuity Formula Calculator Example With Excel Template Annuity Formula Accounting And Finance Resume Writing

12 1 Deferred Annuities Business Math A Step By Step Handbook Abridged

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

The Best Annuity Calculator 17 Retirement Planning Tools

Tax Deferred Annuity Definition Formula Examples With Calculations

Show Clients The Benefits Of Tax Deferral The Standard